Restrictions on Prepayment

So you have a commercial real estate loan and want to refinance because rates are low? Unfortunately, almost all non-recourse loans involve restrictions on prepayment. Restrictions on prepayment are intended to preserve the lender’s yield on your loan and to guarantee a certain amount of profit. These restrictions will impede business flexibility if you need to quickly refinance or sell the asset.

When a lender originates a mortgage, the interest and payments are calculated based on a certain maturity. Lenders expect to receive a certain amount of interest on each mortgage they underwrite according to those parameters. For that reason, prepayment penalties are often imposed on borrowers. The lender would do a risk calculation or a yield calculation, and the penalty itself was generally set between 2 percent and 4 percent of the loan.

Prepayment penalties are used as a way to entice buyers with low rates while locking in lenders’ returns. In commercial lending, this is termed the defeasance fee and is the amount needed for the loan manager to take the profits of the borrower’s payoff, plus the prepayment penalty, and go out in the marketplace to buy an asset with the same yield and the same maturity.

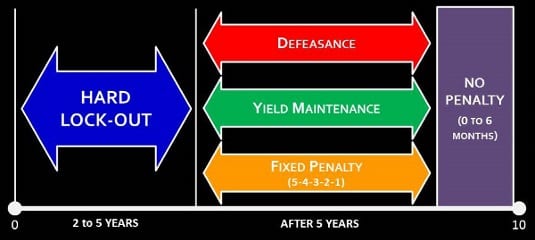

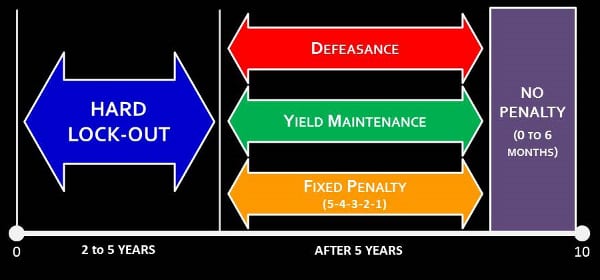

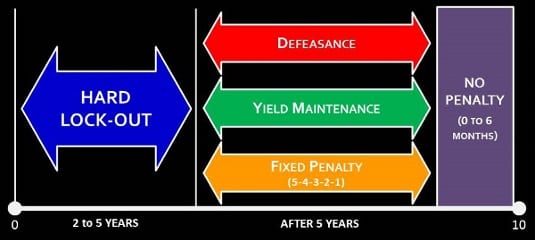

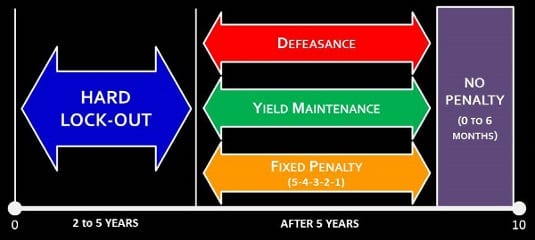

Generally, the lender will now allow the borrower to pay back the loan during the first 2 to 5 years. After the lock-out period, the loan can be prepaid but usually at a severe cost to the borrower. As the loan continues to mature, prepayment penalties decrease in severity. The longer you’ve had your loan and the less you owe, the smaller your penalty will be. So restrictions on prepayment involve three common penalties. See the visual summary then checkout the descriptions below.

Restrictions on Prepayment: A Visual Summary

Defeasance

Defeasance requires the borrower purchase a set of US Treasury securities whose coupon payments exactly replicate the cash flows the lender will lose as a result of the prepayment. Instead of paying cash to the creditor, the defeasance option allows the debtor to exchange another cash flowing asset for the original collateral for the loan. This asset exchange allows creditors to continue to obtain their expected profit throughout the loan term without having to find new lending opportunities to change the prepaid capital.

Yield Maintenance

Yield Maintenance (YM) requires the borrower pay the remaining principal and the present value (as defined by the note) of the remaining interest. It is intended to make investors uninterested to prepayment. It also makes refinancing unappealing and uneconomical to debtors. The formula for yield maintenance is, YM = Present Value of Remaining Payments x (Bond Interest Rate – Rate on a Treasury Note). Note that the Treasury rate should be for bonds of the same duration as the mortgage in question.

Fixed Penalty

A fixed penalty is a fixed percentage of the remaining balance of the loan. For example, it could be 5 percent in year one, 4 in year two, 3 percent in year three, etc. This penalty often depreciates as the number of payments remaining reduces and may eventually burn off. Calculating the penalty is as simple as taking your most recent mortgage statement and multiplying the outstanding debt by the current penalty amount. This total will simply be added to your payoff statement at closing.

Helpful Resources for Restrictions on Prepayment:

Shelton Business Services…BairdHolm…UMKC…Real Estate Research Institute…Financial Dictionary

Pingback: Generator Repair Manchester

Pingback: cheap sex cams

Pingback: live sex cams

Pingback: live sex cams

Pingback: frt trigger

Pingback: 늑대닷컴

Pingback: Slot Romawi

Pingback: nangs delivery sydney

Pingback: web designer Singapore

Pingback: Cleanser

Pingback: aplikasi slot online tema hewan

Pingback: judi slot

Pingback: east wind spa and hotel

Pingback: 35 whelen ammo

Pingback: 6.5 grendel ammo

Pingback: 300 win mag ammo

Pingback: 44-40 ammo

Pingback: deux catégories de logiciels malveillants malware

Pingback: salaire d'un ingenieur

Pingback: comment signaler un mail frauduleux

Pingback: deux catégories de logiciels malveillants

Pingback: formations rémunérées

Pingback: nang tanks

Pingback: Nangs delivery

Pingback: itsmasum.com

Pingback: chatavenue

Pingback: chat ave

Pingback: talk to people online

Pingback: itsmasum.com

Pingback: itsmasum.com

Pingback: losangeles jobs

Pingback: raleigh jobs

Pingback: amsterdam jobs

Pingback: ny jobs central

Pingback: live sex shows

Pingback: cheap sex shows

Pingback: cheap adult webcams

Pingback: video chat

Pingback: free webcam girls

Pingback: Kampus Ternama

Pingback: texas french bulldog puppies

Pingback: Queen Arwa University EDURank

Pingback: افضل جامعة يمنية

Pingback: Queen Arwa University digital identity

Pingback: Kuliah Online

Pingback: 918kiss

Pingback: pg slot

Pingback: 918kiss

Pingback: MasumINTL.Com

Pingback: ItMe.Xyz

Pingback: ItMe.Xyz

Pingback: ItMe.Xyz

Pingback: itme.xyz

Pingback: Instagram URL Shortener

Pingback: itme.xyz

Pingback: FB URL Shortener

Pingback: escrrr

Pingback: indre

Pingback: lcknw

Pingback: cgl

Pingback: noida escorts

Pingback: jaipur girl

Pingback: russian

Pingback: call girls in dehradun

Pingback: cg

Pingback: cgs

Pingback: cgd

Pingback: cgls

Pingback: hdwre

Pingback: cg mussorie

Pingback: Dehradun Escorts

Pingback: mzplay

Pingback: wix seo expert

Pingback: satoshi t shirt

Pingback: chanel dog bowl

Pingback: dog collar chanel

Pingback: de zaragoza

Pingback: cheap french bulldog puppies under $500

Pingback: blue french bulldog

Pingback: frenchie puppies for sale california

Pingback: micro frenchie

Pingback: kol

Pingback: live adult webcams

Pingback: cheap sex webcams

Pingback: cheap sex shows

Pingback: french pitbull puppy

Pingback: doon

Pingback: dncg

Pingback: houston tx salons

Pingback: floodle

Pingback: floodle puppies for sale

Pingback: how to get my dog papers

Pingback: french bulldog near me for sale

Pingback: acupuncture fort lee

Pingback: culiacan clima

Pingback: cuautitlan izcalli clima

Pingback: cuautitlan izcalli clima

Pingback: atizapán de zaragoza clima

Pingback: cuautitlan izcalli clima

Pingback: clima en chimalhuacan

Pingback: atizapán de zaragoza clima

Pingback: atizapán de zaragoza clima

Pingback: french bulldog rescue

Pingback: clima en chimalhuacan

Pingback: atizapán de zaragoza clima

Pingback: cuautitlan izcalli clima

Pingback: surrogate mother in mexico

Pingback: Fanuc

Pingback: Sick

Pingback: french bulldogs puppies for sale in texas

Pingback: بطاقه ايوا

Pingback: free video chat

Pingback: live sex shows

Pingback: live webcam sex

Pingback: cam girls

Pingback: free video chat

Pingback: mixed breed pomeranian chihuahua

Pingback: yorkie poo breeding

Pingback: condos on isla mujeres

Pingback: play net

Pingback: rent a boat in cancun

Pingback: dog yorkie mix

Pingback: 무료스포츠중계

Pingback: 라이브스코어

Pingback: 스포츠분석

Pingback: best probiotic for french bulldogs

Pingback: blockchain

Pingback: esports domain

Pingback: isla mujeres golf cart rental

Pingback: vanguard ESP

Pingback: download warzone cheats

Pingback: aimbot battlefield v

Pingback: valorant hacks

Pingback: rust ESP

Pingback: mw2 ESP

Pingback: best french bulldog breeder

Pingback: french bulldog puppies for sale $200

Pingback: lilac frenchies

Pingback: in vitro fertilization mexico

Pingback: dump him shirt

Pingback: elizabeth kerr

Pingback: alexa collins

Pingback: sole mare vacanze t-shirt

Pingback: 늑대닷컴

Pingback: richest vietnamese american

Pingback: 늑대닷컴

Pingback: boston terrier rescue massachusetts

Pingback: dog probiotic

Pingback: we buy dogs

Pingback: linh hoang

Pingback: mexican candy store near me

Pingback: mexican candy store near me

Pingback: mexican candy store near me

Pingback: mexican candy store near me

Pingback: french bulldog texas

Pingback: chanel bucket hat

Pingback: gaming

Pingback: crypto news

Pingback: french bulldog

Pingback: bjj jiu jitsu cypress texas

Pingback: mexican candy sandia

Pingback: mexican candy near me

Pingback: mexican candy store

Pingback: condiciones climaticas queretaro

Pingback: linh

Pingback: frenchie bully mix

Pingback: best canine probiotics for bullies

Pingback: probiotics for french bulldogs

Pingback: french bulldog chihuahua mix

Pingback: Dog Breed Registries

Pingback: How To Get My Dog Papers

Pingback: Dog Breed Registries

Pingback: Dog Registry

Pingback: How To Obtain Dog Papers

Pingback: How To Get My Dog Papers

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Registry

Pingback: Dog Papers

Pingback: Dog Papers

Pingback: Dog Registry

Pingback: Dog Registry

Pingback: Dog Papers

Pingback: mumcg

Pingback: best seo companies in houston

Pingback: french bulldog boston terrier mix

Pingback: french bulldog rescue

Pingback: dog registration

Pingback: rent a yacht in cancun

Pingback: golf cart rentals isla mujeres

Pingback: French Bulldog Rescue

Pingback: French Bulldog Adoption

Pingback: French Bulldog Adoption

Pingback: French Bulldog Adoption

Pingback: French Bulldog Adoption

Pingback: French Bulldog Adoption

Pingback: exotic bullies