[ux_banner bg=”#555556″ height=”90px” ]

_____

COMMERCIAL LOAN RATES

_____

[/ux_banner]

Commercial mortgage rates for permanent financing of commercial real estate properties.

Property types include: retail, office, industrial, multifamily, self-storage, & mobile home parks.

[row]

[col span=”1/1″]

[title text=”Current Mortgage Rates”]

[/col]

[col span=”1/3″ ]

Commercial mortgage rates for permanent financing of commercial real estate properties.

Property types include: retail, office, industrial, multifamily, self-storage, & mobile home parks. Commercial loan rates based on loan amounts of $1MM to $10MM. Data updated on May 29th, 2014.[/col]

[col span=”2/3″]

| Types / Terms | Retail | Office | Industrial | Apartment | Storage | MHPs |

|---|---|---|---|---|---|---|

| Interest Rate | 4.44% | 4.51% | 4.42% | 4.31% | 5.02% | 4.88% |

| 10-Yr Spread | 2.79 | 2.77 | 2.68 | 2.57 | 3.78 | 3.64 |

| Term / Amo | 6.2 / 25 | 8 / 30 | 11.5 / 24 | 20.5 / 27 | 6.1 / 28 | 9.2 / 25 |

| LTV | 70% | 73% | 70% | 73% | 69% | 70% |

| DSCR | 1.41x | 1.70x | 1.49x | 1.43x | 1.66x | 1.41x |

[/col]

[/row]

[row]

[col span=”1/3″ ]

[mlrates size=”full”]

[/col]

[col span=”2/3″ ][title text=”Interest Rates & 10-Yr Spread”]

As a rule of thumb, 10-year commercial mortgage rates are typically about 75 to 150 basis points higher than a 30-year residential mortgage. For example, the chart to the left indicates 30-year current mortgage rates around 4.50%. So, if you’re refinancing today you should expect a commercial mortgage rate for a 10-yr term / 30-yr amortization loan between 5.25% and 6.00%.

Again, this is the approximate interest rate. At the end of the day, lenders’ mortgage rates are a function of the perceived risk for the loan and they use many factors to build their spread into an interest rate.[/col]

[/row]

[row]

[col span=”1/2″ ][title text=”The LTV & DSCR”]

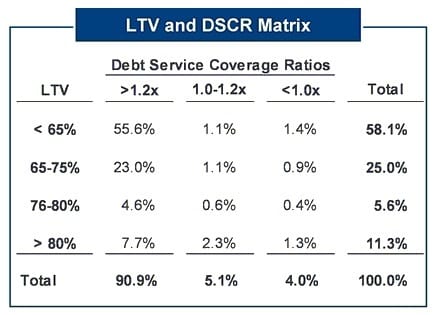

Commercial loan rates are also a function of loan-to-value (LTV) and the debt service coverage ratio (DSCR). Featured to the right is a LTV / DSCR matrix for Metlife’s 2011 Commercial Mortgage Portfolio. As you can see, the majority of loans have a loan-to-value above 65% and a debt service coverage ratio above 1.2x.

Over the past few years, DSCR has not been an issue for borrowers because interest rates have been so low. However, LTV has been a constant struggle for owners. From 2004 to 2007, many borrowers refinanced loans up to 80% loan-to-value. Since that time, most properties dropped in value. In return this has affected the present maximum loan amount for their properties.

[/col]

[col span=”1/2″ ]

[/col]

[/row]