Non-Recourse Loans: More Information You Need to Know

With a non-recourse loan an individual (guarantor) has no personal liability. If the loan goes into foreclosure, the lender can only use the property as collateral for repayment of the loan. However, there’s a catch to these non-recourse loans just like everything else in life. A non-recourse loan can become a recourse loan.

How? There are carveout guarantees within the loan documents that can transfer the liability of a loan to the individual signor. The non-recourse loan only becomes a recourse loan when the borrower engages in negative acts or omissions in connection with the real estate loan. Most commercial real estate professionals refer to these as the “Bad-Boy Carve-Outs”. Below is a set of standard carveouts within the loan

The Standard Carve-Outs

[row][col span=”1/2″]

(1) Fraud or intentional misrepresentation by the borrower.

(2) Contamination waste occurring to or on the mortgaged property.

(3) Gross Negligence or criminal acts of the borrower that result in the forfeiture, seizure, or loss of any portion of the mortgaged property.

[/col]

[col span=”1/2″]

(4) Misappropriation of rents, insurance proceeds, or condemnation awards received by the borrower after the occurrence and during the continuance of an event of default.

(5) Assignment of any sale, conveyance, mortgage, grant, bargain, encumbrance, pledge, or transfer of the mortgaged property, or any part thereof, without the prior written consent of the lender.

[/col][/row]

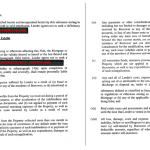

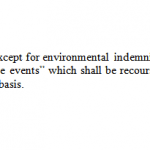

Carve-Out & Guaranty Language from Loan Docs

- Example 1

- Example 2

- Example 3

[row][/row]

The examples discussed above are typical guarantees by a lender. However, each lender has its own list of non-recourse carveouts. Every lender also has a different willingness to change the carve out provisions. Some lenders might change the wording or take one of these acts out totally. Other lenders will not budge on any of the wordage. We advise you to speak with your broker and attorney before negotiating any of these items.

Helpful Resources about Carveout Language:

Investopedia…Wikipedia…Fredlaw…Nolo…NEI Online…RE Journals…MuchShelist